Many federal employees were subjected to an involuntary deferral of payroll tax withholding (OASDI) during the last quarter of 2020. The effect of this action, as ordered by former President Trump, is a higher tax bill for those employees for calendar year 2021.

NFFE lobbied Congress to minimize the financial damage to federal workers on several fronts. Last year, after the order to defer tax payments was signed by Trump, NFFE worked with House and Senate leaders for full relief of the unjust, involuntary tax burden. Separately, NFFE brought a provision to the Senate floor by Sen. Chris Van Hollen (D-MD) to require permission from employees before deferring the taxes. Both provisions failed however NFFE was able to secure an extension for repayment to December 4 from April 30, 2021, lowering the financial drain per paycheck.

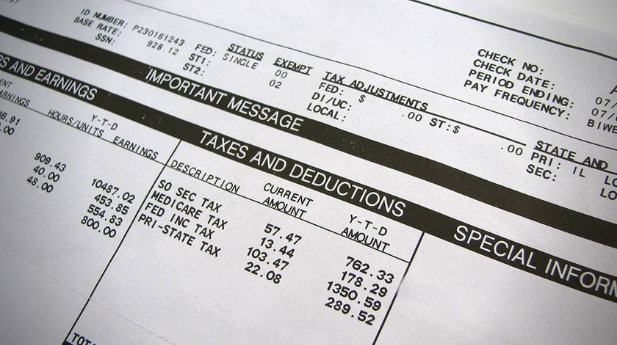

Under the 2021 Omnibus law and standard IRS tax regulations:

- 2020 OASDI tax repayments will be collected over 24 installments, from Jan. 16 to Dec. 4, 2021.

- The normal 6.2% OASDI withholding will also be deducted from paychecks beginning Jan. 2021.

- Beginning January 2021, myPay LES Remarks section will show the 2020 deferred OASDI collection amount as well as your remaining balance to be collected.

- Those separating from Federal service before Dec 4, 2021 and prior to the deferred tax being collected in full, will be responsible for the remaining tax repayment. The unpaid balance will be collected from the final paycheck. If there are funds still remaining to be collected, employees will receive a debt letter with instructions for repayment.

NFFE continues to work with Congress and the Biden administration to lobby for full relief of the tax burden forced on federal workers and their families. If you have any questions regarding OASDI taxes or the repayment schedule, employees are encouraged to contact their agency human resources officials.